2018 POS Software Trends Report

Tracking restaurant technology investments has revealed a slow, but steady shift. For many years, tech budgets took a backseat to operations with restaurants focusing spend on service and operations in order to improve customer experience. The evolution is that technology cannot be separate from experience. The digital age has inexorably linked both.

Hospitality Technology’s annual “POS Software Trends Report” polls restaurant technology executives to uncover what features are top of mind for POS upgrades and what trends will influence 2018 purchasing plans. What becomes evident is that as experience has become a main business driver, the point of sale must go beyond mere transactions to forge a deeper connection between sales and engagement.

The POS is on the frontlines ushering restaurants through this age of digital transformation. Almost half (49%) of restaurant operators plan to add new functionality and features to POS software. Purchasing plans (Figure 1) illustrate that compared to 2017, only two areas will see an uptick in operator action. More operators are looking to develop and/or deploy mobile POS than last year, 37% compared to 28%; and 32% of operators plan to switch vendors in 2018.

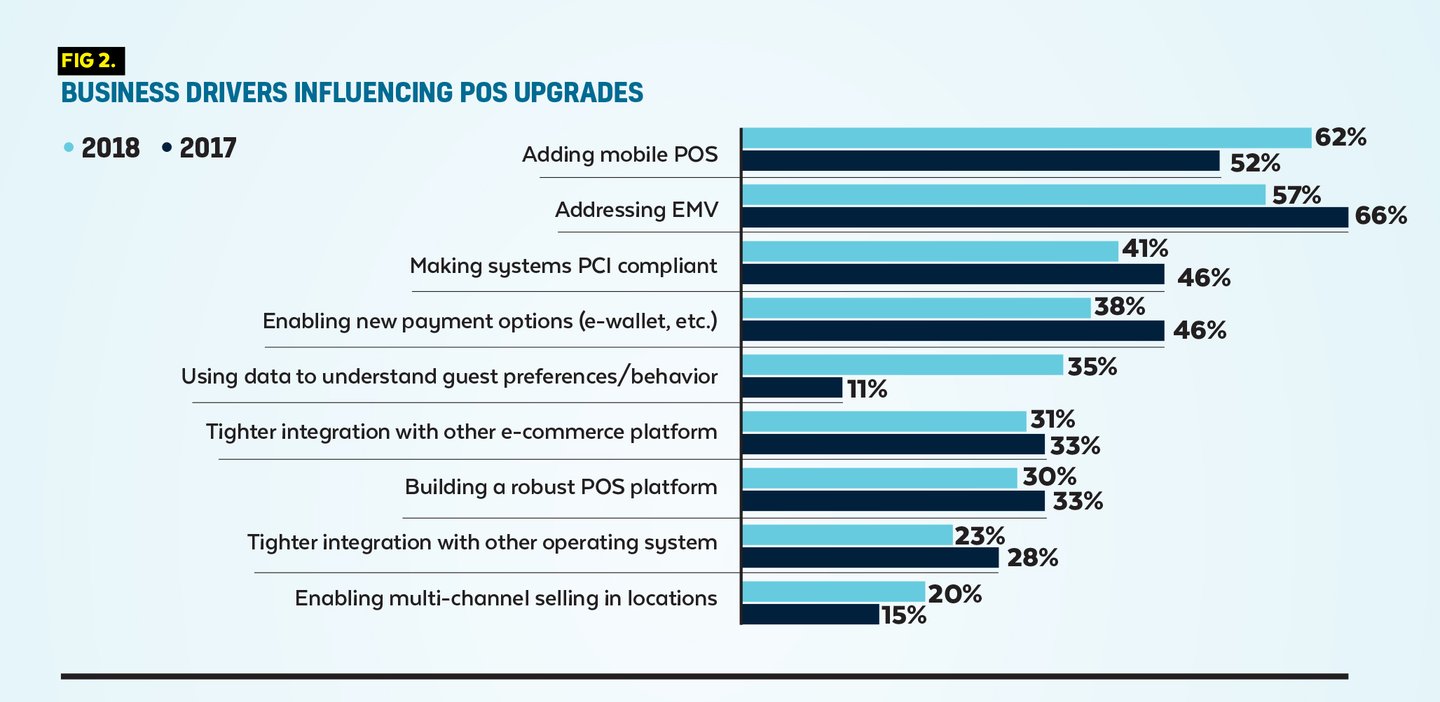

Mobility continues to be a major concern in point of sale activity and about two out of five are prioritizing developing or deploying POS for a mobile device. After two years of being edged out by preparing for EMV, adding mobile POS was selected as the number one business driver influencing upgrades for 2018 (Figure 2). Enabling new payment options made the top four with 38%. As restaurants and the broader retail industry as a whole have not reached a consensus on mobile payments, acceptance and widespread rollouts have stagnated somewhat, but restaurants must be prepared as diners seek experiences similar to online shopping.

During an interview for HT’s October cover story, Mike Nettles, SVP & chief digital officer of Papa John’s cautioned, “If we don’t make it as easy for guests to part with their money as Amazon does, then we’re missing out on some big opportunities.”

About 1 out of 3 restaurants (31%) will be focusing on tighter integrations with e-commerce platforms. “I think that’s been a huge change that many less mature digital players haven’t quite realized yet,” Nettles says. “It’s no longer a matter of being compared to another restaurant. Restaurants are being compared to the best digital experiences.”

The most marked increase seen this year is the number of operators looking at POS software to serve as a data scientist. In last year’s survey, only 11% of operators named clienteling (using data to understand and predict guest behavior) a business driver for POS upgrades. This year, 35% said it was influencing upgrades.

Two years post-liability shift, more than half of operators admit they have yet to address EMV. Restaurants have been sluggish to adapt to EMV as companies weigh the cost of hardware upgrades against potential chargebacks. Making systems PCI compliant moved up to third place. As hospitality remains a top target for hackers, developing a multi-tiered approach to security is vital. EMV is not a security solution by itself, but rather should be combined with other measures such as tokenization and encryption. Similarly, PCI compliance doesn’t ensure a breach won’t occur, but can reduce the probability and therefore is rightfully a top priority.

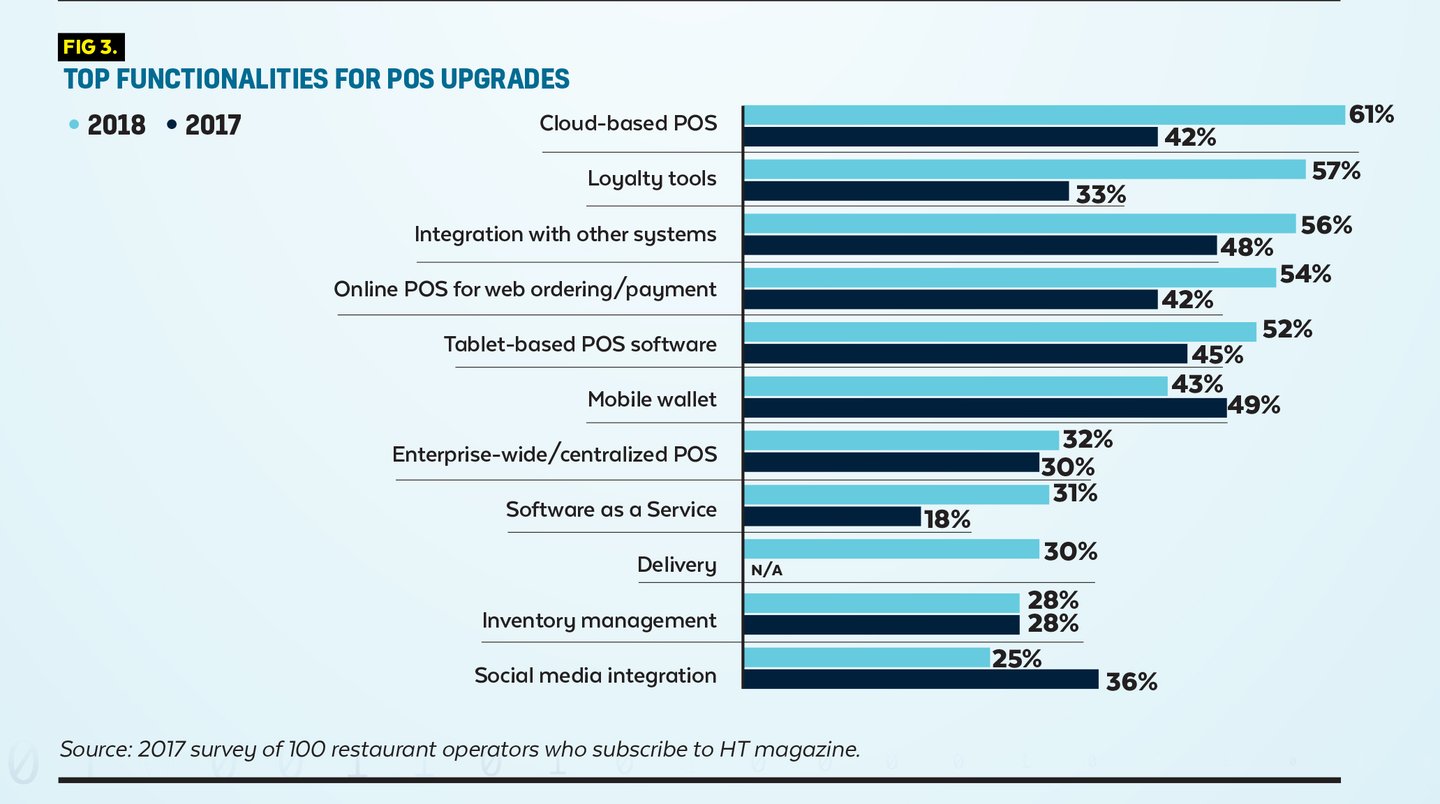

Ranking specific features desired for POS upgrades, cloud, which for the last several years failed to make the top three, reclaimed the top spot for 2018 upgrades with 61%. Above-property functionality had the second largest increase from last year’s survey. The biggest jump in functionality went to loyalty tools, going from 33% to 57%. Mirroring the trends in strategies and priorities elsewhere, more than half of operators will be looking for POS software that enables them to offer online ordering and payment.

Overall, we see a pattern emerging that restaurants are looking to the POS to provide the level of cross-channel and personalized service that e-commerce hungry diners are demanding. Next, we take a look at what the POS software supplier community is doing to address that demand...

POS SOFTWARE REPORT: TOP FEATURES & 2018 PREDICTIONS

AGILYSYS (www.agilysys.com) made enhancements to its InfoGenesis POS and InfoGenesis Flex products which include improved payment security, additional integrations, and enhanced POS mobility. Most innovative features: Mobility and self-service technologies to promote more revenue opportunities while improving guest satisfaction, and integrated technologies to provide real-time business insights for predicting trends, identifying performance patterns and anticipating guest preferences. In 2018, Agilysys will continue its focus on technology enhancements that provide improved interface and management controls.

AIREUS INC. (http://aireus.com) improved its reporting and trending capabilities with richer insights, developed an enterprise iPad self-serve kiosk, added tighter integration with POS and back-office tools, and continued to focus on third-party API integration. It also completed risk assessment processes and is now SOC 1 and 2 compliant. Most innovative feature: Aireus Inc. offers clients an online portal where they can leverage iPad POS, order-at-table, online ordering, mobile ordering, iPad Kitchen Display and kiosk ordering. Aireus can run without Internet connectivity and operators can access POS and back-office applications on mobile devices. In 2018, Aireus plans to offer smart KDS all on an iPad, social media integration, and broader-based features that include non-POS functionalities such as social media integration, events notifications and staff management tools and lists.

BITE KIOSK (www.bitekiosk.com) created self-ordering kiosks with facial recognition technology and a learning algorithm. Most innovative feature: Facial recognition technology recognizes guests and shows order history; it also predicts new items they might be willing to order and displays those as well driving upsells and adding personalization. In 2018, Bite Kiosk plans to continue driving personalization.

CLOVER (www.clover.com) introduced Clover Flex, a dual handheld/countertop smart payment terminal that is meant to fit comfortably in the hands of merchants. It allows operators to take orders in line, at a counter, or at tables. Most innovative feature: Clover Flex offers a transaction time of less than three seconds and processes nearly any payment mechanism available in the last 20 years including NFC transmission, electronic gift cards, PIN entry, chip cards under the EMV standard and straight magnetic stripe transactions. It is also one of the first terminals in the United States to accept AliPay. In 2018, Clover will continue to work with thousands of software companies to evolve, including CareCloud and Bypass.

CUSTOM BUSINESS SOLUTIONS INC. (http://cbsnorthstar.com) began testing Windows-based OS functionality for NorthStar POS. Adding the Windows platform gives NorthStar the capability to run on a multitude of new hardware options. It also continues to update its user interface, features and reporting capabilities. Most innovative feature: Localization: The end user can toggle between multiple languages in a guest-facing or kiosk environment, and the staff interface can support multiple languages. In 2018, wearable technology for POS is going to make waves. Stay tuned for interesting integrations between several large companies.

FUTURE POS (http://web.futurepos.com) launched a cloud offering, enhanced its mobile POS for iOS and Android, and released a WYSIWIG editor for the Future POS front of house that allows for drag and drop creation of custom POS screens. Most innovative feature: Cloud functionality in a legacy POS system; and Future POS’ mobile POS is a cross platform app that runs on both iOS and Android. In 2018, the company will be releasing a full enterprise cloud package that will compete with top tier POS systems, and its mobile POS will be ported to a PAX A920 for full order and pay-at-the-table functionality.

GIVEX (http://web.givex.com) introduced Vexilor, a scalable POS system engineered to be an end-to-end business management solution. Featuring Kitchen Display Systems, Resource Management, Inventory Control, and Tableside Ordering, the customizable solution streamlines all aspects of a business, while providing real-time data to operators and free 24/7 support. All features within Vexilor are designed to work in harmony with Givex’s entire suite of products, such as the Tiqer Tableside Ordering platform. Most innovative feature: Vexilor manages restaurant operations and guest engagements using the cloud. This cuts down on restaurateurs’ workload while giving them data and resources to grow their business. The real-time management capability boosts dependability of an on-site server at every location to guarantee uptime and performance.

HARBORTOUCH (www.harbortouch.com) released Harbortouch Bar & Restaurant. It features a streamlined, intuitive order interface for maximum speed and efficiency, and it supports a number of innovative add-on modules such as tableside iPad ordering, online reservations, and integrated online ordering. It also supports EMV transactions with tip adjust. Most innovative feature: The ecosystem of services that accompany Harbortouch’s POS software including Lighthouse online reporting and POS management portal, iPad-based tableside ordering solution, and the integrated online reservations and online ordering modules. In 2018, Harbortouch will launch new SmartPOS functionality featuring advanced analytics, promotion management, sales tactics and more.

NCR (www.ncr.com) integrated Aloha POS with its Omni-channel Platform which created more opportunities for restaurants to leverage applications from NCR and its partner community in areas such as loyalty, CRM and order-ahead. It also integrated DoorDash and Grubhub with NCR Aloha. Most innovative feature: Enabling customers in multiple ways to seamlessly find and integrate apps and solutions to fit their brand as well as the investment and integration of Aloha POS into NCR Omnichannel Platform. In 2018, NCR will focus on delivery and self-service. NCR will grow its customer self-ordering solution by providing more hardware and software solutions optimized for self-service.

OMNIVORE (http://omnivore.io) connected numerous apps in reservations, online ordering, delivery, payments and more to multiple POS systems. It also launched the Omnivore Marketplace, a space for restaurants to discover and activate these technology apps. Most innovative feature: Using the Omnivore API, app developers only need to integrate once to connect to many POS systems. In 2018, Omnivore is adding more third party apps into the Omnivore Marketplace joining solutions like Instant, MarketMan, and TableUp.

ORACLE HOSPITALITY (www.oracle.com) launched two new cloud services: Oracle Hospitality Menu Recommendations Cloud Service and Oracle Hospitality Adaptive Forecasts Cloud Service. The Menu Recommendations Cloud Service provides menu item suggestions to cashiers and servers, and the Adaptive Forecasts Cloud Service improves labor and inventory forecasting accuracy. It also launched Oracle Hospitality Reporting & Analytics 9.0, which brings Oracle Business Intelligence – Enterprise Edition to the hospitality market. Preconfigured reports allow operators to see the OBIEE benefits. Enterprise customers familiar with OBIEE can use its toolkits to create rich visualizations and explore data new ways. Most innovative feature: Oracle Hospitality Data Science Cloud Services empower food and beverage operators to analyze key information such as sales, guest, marketing and staff performance data generating insights.

PAR TECHNOLOGY CORP. (www.partech.com) brought Brink cloud POS, predominantly enjoyed by the fast casual segment to large quick service franchise organizations. Most innovative feature: An expanding web API with a growing ecosystem of web integration partners, extended feature set for the built-in kitchen display, and advanced combo support for Brink Cloud POS. PAR offers a modern PixelPoint POS back office UI with the addition of Lucene search and added support for on screen payment signature capture. In 2018, PAR will offer more efficient options for quick service self-ordering that go beyond the typical fixed stand kiosk.

PCMS (www.pcmsdatafit.com) expanded its integrated single product to include POS, self-scan checkout, mobility, hospitality on mobility with integrated EMV and consumer mobile apps. Most innovative feature: Diners can use a tablet to view the menu with the server who can send instructions to kitchen staff and offer pay at the table using integrated mobile EMV. Restaurants, in turn, gain real-time visibility into the inventory of recipe ingredients to reduce waste from over-ordering and out-of-stocks. In 2018, PCMS is developing its enterprise POS registers by expanding its mobile applications through an Apple- and Android-compatible mobile solution. It is also working to transform traditional POS registers into self-scan technology allowing shoppers to serve themselves.

RESTAURANT MANAGER (www.rmpos.com) developed a new direct integration for EMV payments that reduces transaction time by about 40%. Most innovative feature: A split check interface in the POS. With dynamically resizing “check” windows, users can easily split large tables, including splitting individual menu items. It also offers a handheld POS app that runs on iPod Touch, iPhones and iPads for tableside order entry. In 2018, Restaurant Manager will see a big push into more payment technology, including mobile and consumer facing payment apps.

REVEL SYSTEMS (https://revelsystems.com) introduced Revel Advantage, thatallows merchants to process credit cards and multiple payment forms as an integrated component of the Revel POS platform. The EMV-ready solution facilitates multiple payment types and ensures fast and secure transactions, favorable payment rates, and the service and support benefits of a single vendor. Most innovative feature: Hybrid architecture POS system can be enabled to run offline and process all transactions. Revel offers a self-service kiosk to help with peak hour rushes to eliminate communication errors and product waste. Fully integrated and centralized management system offers features from workforce, ingredient-level inventory, and kitchen management to omni-channel solutions like online and mobile ordering. Revel Insights, management app provides real-time reporting from the Revel POS platform to any mobile device.

REVENTION (http://revention.com) released its delivery module that includes an integration to Google Enterprise Maps. The POS will keep track of delivery drivers’ mileage based on Google’s recommended route. The geofence defining the delivery area of the store is seamlessly shared between the POS, online ordering and mobile applications to ensure consistency across all ordering platforms for delivery areas and fees. Most innovative feature: Seamless continuity between POS, online ordering, mobile ordering app, loyalty, and enterprise management. When a custom integration is required, Revention offers an open database architecture as well as custom API development. In 2018, Revention will release a hybrid-cloud POS that leverages the mobility of tablets. It is also looking toward integrated mobile EMV solutions for pay at the door.

SALIDO (http://salido.com) debuted a Multiple Service Type feature which offers Quick Serve, Bar Speed Screen and Full Service configurations across revenue centers in one location; EMV Support with chip and signature for payments, and the addition of House Accounts where one can close checks to specific house accounts. Most innovative features: Salido's Mobile Manager App allows managers to view revenue, labor and product mix history from their phone; One Touch Location Add enables multi-unit operators to clone existing locations/set-ups instantly when installing new locations; and Price Level Support provides different prices across various locations, accommodating a variety of cost structures. In 2018, Salido will add Net Contribution Margin Per Item which will let operators know their profit per item based on pour and plate cost; a SALIDO API to streamline reservations, ordering, order ahead, reporting, labor and other data feeds; will expand its KDS offering from Quick Service to include Full Service; will add a Server Performance function to know a server’s margin contribution in addition to total sold and check average; and Order Ahead and Ordering Integrations partnerships with LevelUp, OLO, Brandible and Chowly.

SHOPKEEP (www.shopkeep.com) expanded the suite of tools within its POS platform, integrating with e-commerce software BigCommerce and acquired ChowBOT software to enhance online ordering, payment and delivery capabilities. Most innovative feature: Cloud-based POS eliminates the need for costly upgrades and dismisses security concerns associated with traditional client-server systems. Its web-based BackOffice software empowers clients to manage the business from any Internet connected device. In 2018, it will add product features such as SMS messaging for order status and order confirmation as well as curbside pickup.

SOFTTOUCH POS (http://softtouchpos.com) releaseda cloud-based POS that provides more flexibility for web service integration with numerous services including data analytics, marketing, reporting, online ordering and remote access. Most innovative feature: A continued effort toward automation and customer-facing solutions that includes fortifying its DineBlast Mobile product to allow customers full control over checks at table-service and fast casual restaurants. In 2018, it will focus on customer-facing solutions including a more powerful kiosk product.

SPEEDLINE SOLUTIONS INC. (www.speedlinesolutions.com) added a range of new analytics and mapping capabilities to help operators identify potential theft and improve delivery efficiency. The company also introduced new payroll and enterprise reporting integrations. Most innovative feature: SpeedLine offers dispatch and delivery time analytics, a driver performance dashboard, hands-free navigation and customer communications with ETAs live-updated at dispatch.

TABLESAFE (www.tablesafe.com) completed its EMV certification and product validation in select restaurants of its RAIL pay-at-the-table platform to accept EMV (chip card) payments. Most innovative feature: RAIL is the first EMV-certified and PCI compliant customer-controlled pay-at-the-table platform. It offers a payment agnostic platform allowing guests to self-pay with their credit card or Samsung Pay. It also allows guests to auto-calculate tips, split the bill multiple ways, and the ability to split by item and receive email receipts. In 2018, the RAIL will offer the ability to pay with other mobile apps, including Apple Pay and Android Pay as well as QR and pin-based payments.

TOAST (https://pos.toasttab.com) introduced a Discount Engine, which gives restaurants peace of mind that promotional dollars were put to good use. The company added support for more advanced modifier configurations such as half modifiers, and partnered with companies such as Harri, HotSchedules, Proliant and Olo. Most innovative feature: The POS sends an automatic text to a customer when their order is ready to be picked up and it attached a loyalty account to a credit card so that guests can still be rewarded even if they’ve lost the loyalty card. In 2018, TOAST is on track to make large strides with its KDS.

TOUCHBISTRO (www.touchbistro.com) expanded partnerships with services and apps, integrated with Apple Pay, Samsung Pay and Vantiv TriPOS and Square for easy mobile payments. It integrated with Avero to improve operating reports and added TouchBistro Kiosk, a loyalty app, marketing intelligence and online ordering capabilities. Most innovative features: TouchBistro Loyalty allows customers to top up, pay, collect and redeem points, it also provides customer preferences and purchasing habits to the operator to help with personalized marketing campaigns, and third party online orders/delivery services are routed automatically into its POS.

UPSERVE (https://upserve.com) partnered with Grubhub, Seamless, Menufy, and Chowly to integrate online ordering directly into Breadcrumb POS and created a new online ordering platform to streamline operators’ process of fulfilling online orders. It also launched Upserve Live, a mobile app that delivers near real-time POS activity, such as sales by hour and labor costs, as well as a Training Mode to help train employees on the restaurant POS system. Most innovative feature: The POS gathers data and feeds it into Upserve’s other systems so that operators have a complete picture of restaurant performance. In 2018, Upserve is building out capabilities that align with key concerns such as labor costs and employee satisfaction, and enterprise features built for restaurants as they scale growth.

VIVONET (www.vivonet.com) re-engineered its product to minimize system downtime and reduce configuration expenses. The system was optimized to effectively handle connectivity issues and ensure system performance with offline status. Vivonet also released Vivonet Kiosk – a new Windows-based product that can be set up as a self-serve check-out station or in dual mode, allowing for businesses to switch between self-serve and a standard POS terminal. It also implemented full functionality with P2PE payment integration including tokenization, NFC, EMV, store and forward and pay at the table functionality. Most innovative feature: Vivonet Cloud POS has a native cloud architecture, and harmonizes multiple items across multiple locations or the entire organization, for clarity in reporting and inventory This offers enterprise reporting that allows executives to look at data from a single location or multiple units. In 2018, Vivonet will be prioritizing usability improvements, such as continued user interface enhancements to make service more efficient, optimizing its API for tighter partner integrations, and continuing to improve its AWS-based cloud infrastructure.