Tech-Centric Management Company Launches to Support Independent Hotels

Recently, Life House, a tech-enabled hotel brand and management company, announced the launch of Life Hospitality, a third-party hotel management company focused on maximizing profitability for independent hotels. To support owners in particular need following COVID-19’s impact, Life Hospitality is offering no transition fees and no management fees until 2021.

HT spoke with Bryan Dunn, Head of Growth, Life Hospitality to learn more about this initiative and how it can benefit independent hotels right now.

What is Life Hospitality?

Life Hospitality is a hotel management company for independent hotels. It offers real estate owners access to a tech-enabled operator with proprietary built in-house software that increases bottom-line cash flow and maximizes investment returns.

What are you offering to do for independent hotels during the COVID-19 pandemic?

Life Hospitality is offering no transition fees and no management fees until 2021. With demand levels at record lows, owners are actively seeking new ways to leverage technology to protect their bottom line. However, with debt markets effectively frozen, there is less appetite from owners than in recent years to renovate or rebrand their assets. With increased inbound interest from existing independent hotel owners seeking a tech-enabled management solution without a re-branding or renovation, we felt this was the right time to formally launch our independent management company to the market.

How does your hotel technology stack reduce costs?

We have automated or centralized all traditional back-office functions in the hotels that we operate, eliminating significant expense burden from ownership's P&L in a non-speculative manner. With no required Finance & Accounting, Revenue Management or Sales & Marketing staffing on-property, we're able to drive quantifiable cost savings to the bottom line for our owners, and by handling these complex functions centrally leveraging in-house built technology, we're able to maintain a high caliber of execution without the need to burden the P&L with hefty billbacks. Beyond delivering a material increase in NOI, this approach enables us to effectively de-risk the operation for our owners, as there is less P&L exposure associated with hiring, training and oversight of highly specialized functions at each location.

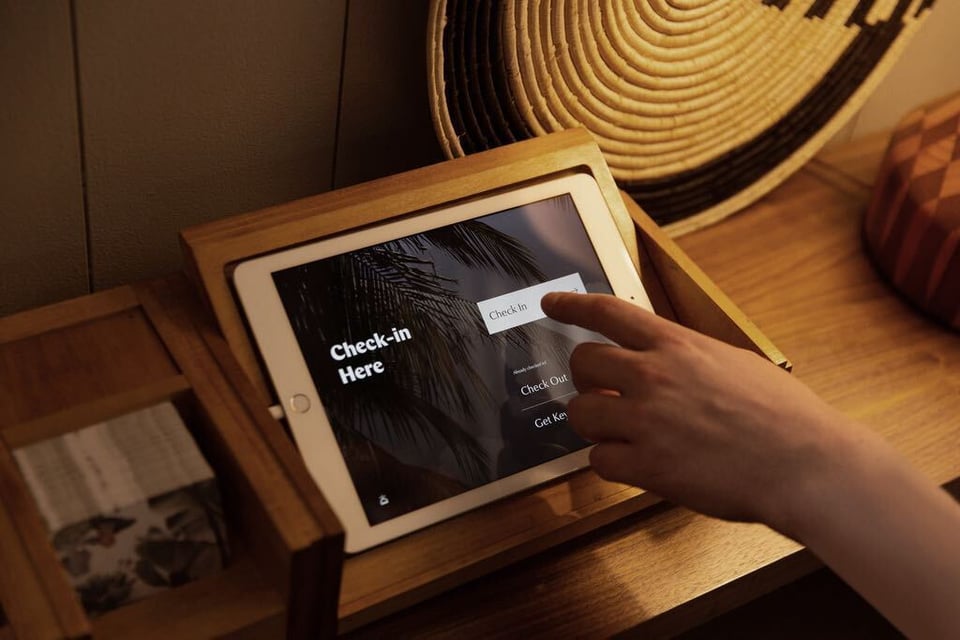

Life Hospitality is able to take over existing hotels in as little as one week and train staff on its intuitive software in a single day. How is that possible?

As a tech-enabled management company, we are the de-facto customer of our own technology. This allows us to have an extremely tight feedback loop relative to a SAAS company, which builds a software product with a broad range of features to maximize their Total Addressable Market, then sells that product to the widest array of external customers for day-to-day use. The result is that we can efficiently build and implement the precise features we require in order to perform on behalf of our owners, in effect enabling us to continuously enhance our value proposition on a forward looking basis.

In terms of takeover timeline, with no back-office on-property and a turn-key technology stack that we built with scalability at top-of-mind, we're able to handle much of the typical pre-opening scope off-site, leveraging our strong corporate team in a capacity that we do not need to bill to our owners. From a property-level onboarding standpoint, we have built intuitive tech-enabled training tools to ensure that we're able to train hourly staff with tremendous ease. Generally speaking, our local team members express that they find our employee-facing software to be much more intuitive than the legacy systems they have used at other hotels.

In the future, would you consider selling your hotel technology to the big brand players - or will this remain for the independent market only?

There are more than 22,000 independent hotels in the U.S.A. alone, with an average key count that is ~40% below that of flagged assets. With very few sophisticated competitors in either the small hotel or independent hotel space, and a technology stack that provides us with a defensible and long-term competitive advantage relative to our peers, we plan to remain hyper-focused on the independent space for the forseeable future.