Group Booking Outlook and ADR Growth Provide Timely News for North American Hoteliers

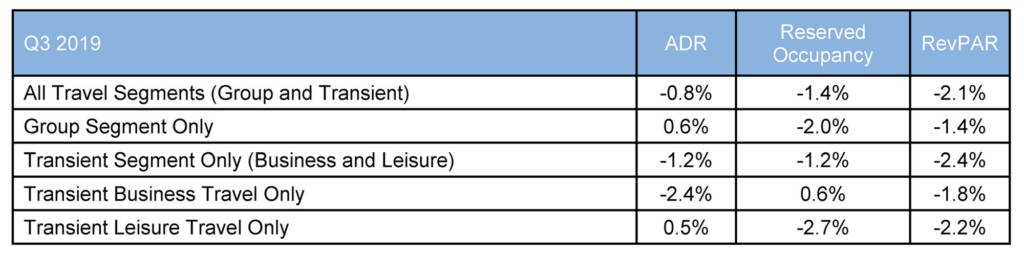

TravelClick, an Amadeus company, released new data from the Company’s August North American Hospitality Review (NAHR). According to the data, average daily rate (ADR) is down -0.8% based on reservations currently on the books for 2019. Group ADR is up 0.6%, while transient segment ADR is down -1.2% compared to the previous year. Transient business ADR is down -2.4%, while transient leisure is up 0.5%.

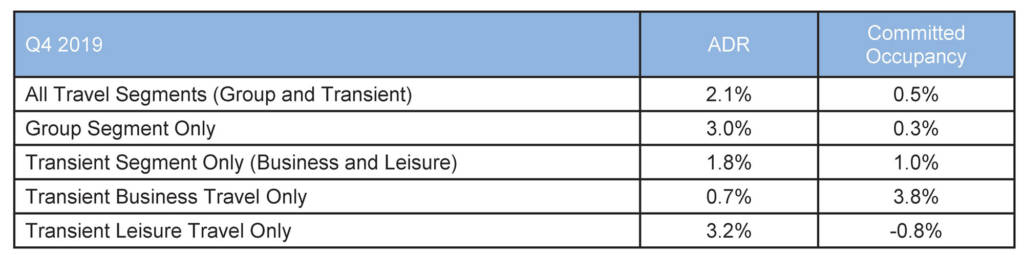

According to TravelClick, for the first time in several months there is consistent and encouraging news for North American Hoteliers. This is becoming evident in the group segment outlook which is demonstrating signs of stability on multiple fronts; growth in year over year group bookings, new commitments added over the last month, and an uptick in average daily rate.

Twelve-Month Outlook (August 2019 – July 2020)

For the next 12 months (August 2019 – July 2020), transient bookings are down -0.7% year-over-year, and ADR for this segment is down -0.4%. When broken down further, the transient leisure (discount, qualified and wholesale) segment is down -2.0% in bookings, while ADR is up 1.3%. Additionally, the transient business (negotiated and retail) segment is up 0.9% in bookings, but down -0.7% in ADR. Lastly, group bookings are up 1.3% in committed room nights* over the same time last year, and ADR for this segment is also up 1.4%.

Although the group outlook is positive, there remains ongoing weakness in several areas, most notably throughout the leisure transient segment, TravelClick explained. The struggles are formidable, and due in part to new hotel inventory coupled with ongoing competition from alternative accommodations. These factors are creating challenges in generating leisure ADR growth, especially in capturing demand from cost conscious vacation travelers. Therefore, it is becoming even more imperative for hoteliers to leverage advance pacing business intelligence and online marketing solutions to attract new leisure guests.

The August NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by August 1, 2019, for the period of August 2019 – July 2020.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity.

The second quarter combines historical data (July) and forward-looking data (August – September).