Overall Customer Satisfaction with Hotels Falls 3.9% in the Last Year

When the COVID-19 pandemic hit the United States, travel industries were among the first businesses to take the brunt of the global crisis—and no segment was spared.

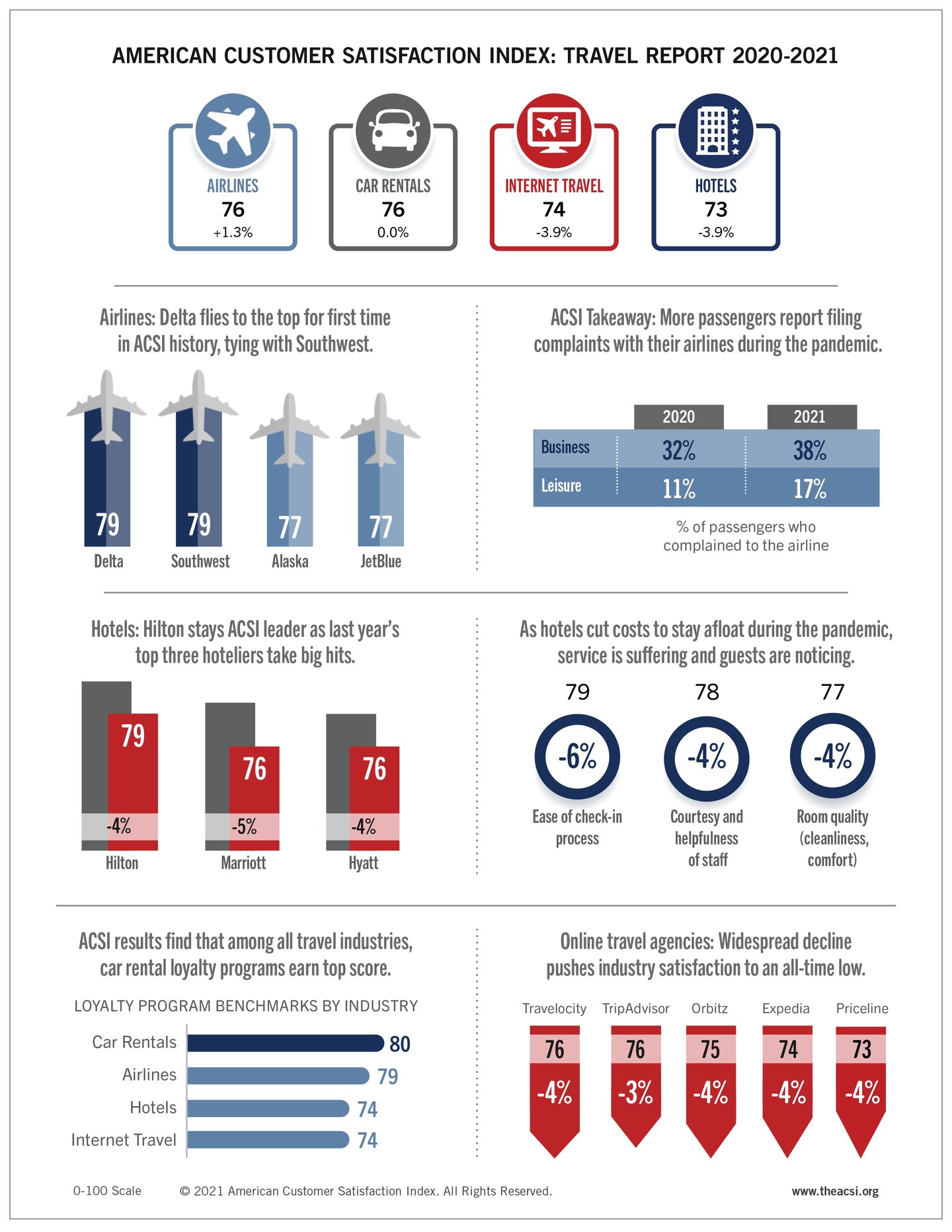

According to the American Customer Satisfaction Index (ACSI®) Travel Report 2020-2021, only airlines keep customer satisfaction moving in a positive direction. The car rental industry holds steady, yet guest satisfaction for hotels heads south, as almost every major chain experiences ACSI losses. Satisfaction with online travel agencies sinks to an all-time low.

“Prior to the pandemic, the state of customer satisfaction among airlines and hotels was on the up and up,” says David VanAmburg, Managing Director at the ACSI. “Airlines were soaring, following back-to-back yearly gains in passenger satisfaction, and hotels displayed slight improvement year over year. But COVID-19 has caused these industries to veer in opposite directions. While satisfaction with airlines surprisingly continues to soar, hotels have been hit harder than ever before.”

This report provides customer satisfaction results across four travel industries – airlines, hotels, car rentals, and internet travel services – based on surveys conducted from April 2020 to March 2021.

Delta flies to the top, tying Southwest

Despite the financial strain on the airline industry during the global pandemic, passenger satisfaction has never been higher. The industry overall climbs 1.3% to its best-ever ACSI score of 76 (out of 100).

Southwest remains at the top of the industry with an unchanged ACSI score of 79. However, for the first time, Delta shares the number-one position, climbing 3% year over year to reach a new high score.

Alaska Airlines and JetBlue both slip 1% to tie for second place at 77. The remainder of the field is below the industry average, with two major legacy carriers deadlocked at 75: American (up 1%) and United (unchanged).

Smaller carriers make big strides amid the pandemic, up 6% to a combined score of 74. Moving in the opposite direction, budget-minded Allegiant falls 3% to 72. The bottom of the industry belongs to ultra-low-cost carriers Frontier, which rises 3% to 68, and Spirit, which climbs 2% to 66.

Hotels hit with satisfaction nightmare

The hotel industry has taken a beating during the pandemic.

Customer satisfaction has not been this low in over a decade, as guest satisfaction overall tumbles 3.9% to an ACSI score of 73. The downward trend spans much of the industry, with five of eight major hoteliers posting ACSI declines of 3% or higher.

Hilton remains the industry satisfaction leader, but at a much lower level from the prior year, down 4% to 79. IHG earns second place with a stable score of 78. Marriott suffers the sharpest decline in guest satisfaction, tumbling 5% to 76. Hyatt joins Marriott in third place after dropping 4% to 76, while Best Western sits in fourth, slipping 1% to 75.

The remaining hotel operators score below average. Choice ebbs 3% to 71, followed by the large group of smaller hotels, down 3% to a score of 70. Wyndham is next, slumping 4% to 69. Bringing up the rear is G6 Hospitality (Motel 6) – the only hotel operator to improve guest satisfaction – up 2% to a high of 66.

Internet travel sites sink further still

For the internet travel service industry overall, user satisfaction plummets 3.9% to an all-time low ACSI score of 74.

Declines in user satisfaction for Travelocity (down 4%) and TripAdvisor (down 3%) place the two travel sites in a tie for the industry lead at 76. Orbitz is next, stumbling 4% to an ACSI score of 75, followed by Expedia’s namesake site, which sinks 4% to a record low of 74.

At the bottom of the industry, smaller online travel agencies also post a record low, plummeting 5% to 73 and tying Priceline, which plunges 4%.

Enterprise holds the top spot among car rentals

Following its ACSI debut in 2020, the car rental industry posts a steady score of 76.

For the second time, Enterprise Rent-a-Car leads the industry in customer satisfaction, despite slipping 1% to 78. Dollar makes a big move for 2021, rising 4% to grab second place at 77.

The remaining car rental companies meet or fall below the industry average. Alamo dips 1% to 76, just ahead of three brands deadlocked at 75: Avis, up 1%; Hertz, up 1%; and National, down 3%.

The low end of the industry remains the territory of Budget, Thrifty, and the group of smaller car rental companies. Budget stays pat at 73, while Thrifty jumps 4% to 72. The group of smaller firms – unmoved at 71 – now sits at the bottom of the industry.

The ACSI Travel Report 2020-2021 on airlines, hotels, car rentals, and internet travel services is based on interviews with 7,898 customers. Respondents were chosen at random and contacted via email between April 1, 2020, and March 28, 2021. Download the full report, and follow the ACSI on LinkedIn and Twitter at @theACSI.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.