Global Cancellation Rate of Hotel Reservations Reaches 40% on Average

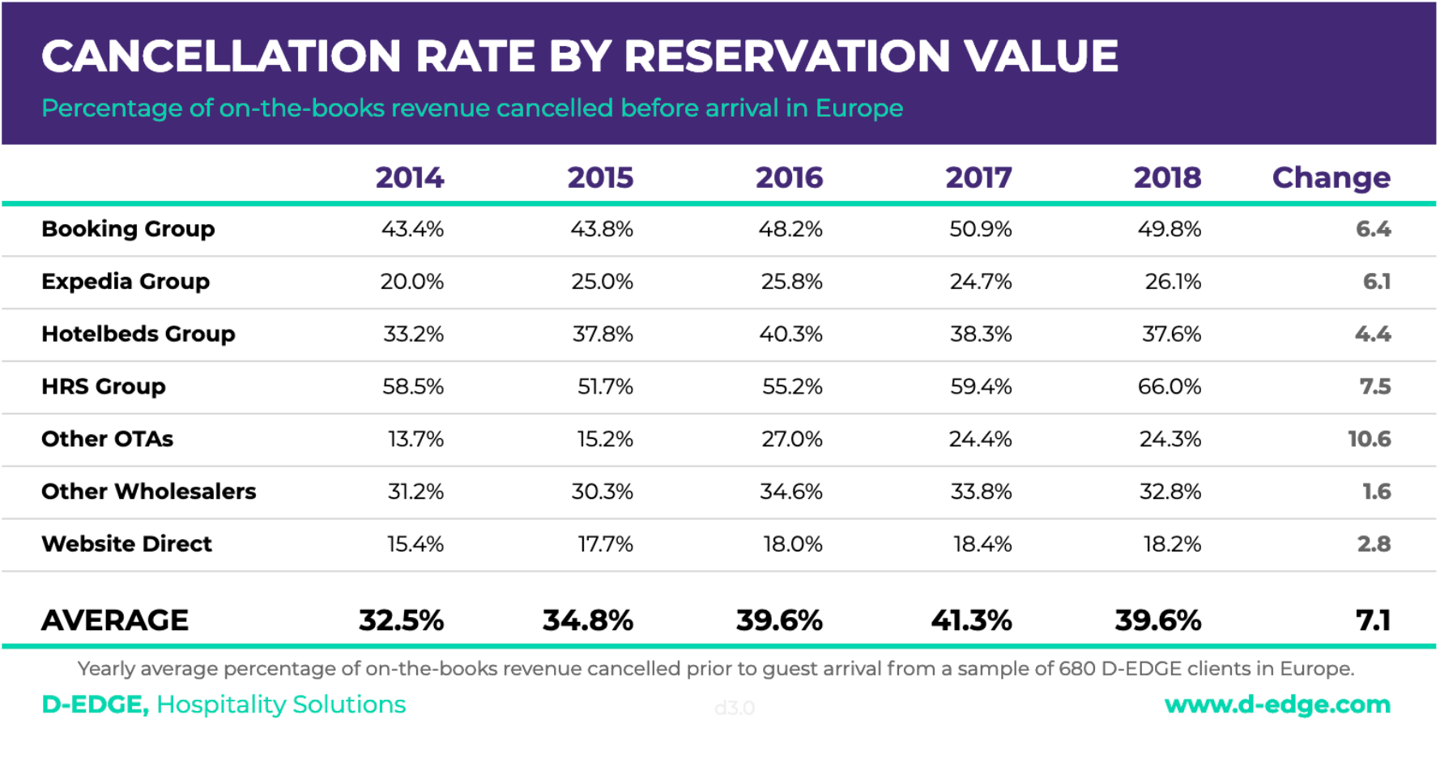

D-Edge Hospitality Solutions, part of the Accor-owned hotel technology group, said it analyzed the online distribution performance of more than 200 different channels for 680 properties in Europe between 2014 and 2018. When analyzing the data, D-Edge found that, with the exception of 2018, every single channel has observed a marked increase in cancellation rate YoY. And, even in 2018, the number was 7.1 points above 2014. With a global average of almost 40% cancellation rate, this trend produces a very negative impact on hotel revenue and distribution management strategies. Website Direct has kept the lowest cancellation rate of all channels, though it too increased by 2.8 points.

d-Edge believes that guests have become accustomed to free cancellation policies that have been made popular (and encouraged) mainly by Booking.com and channels and apps such as Tingo or Service, designed to cancel and rebook hotel rooms at each rate drop.

According to D-Edge, this customer behavior hinders accurate forecasting, eventually resulting in non-optimized occupancy.

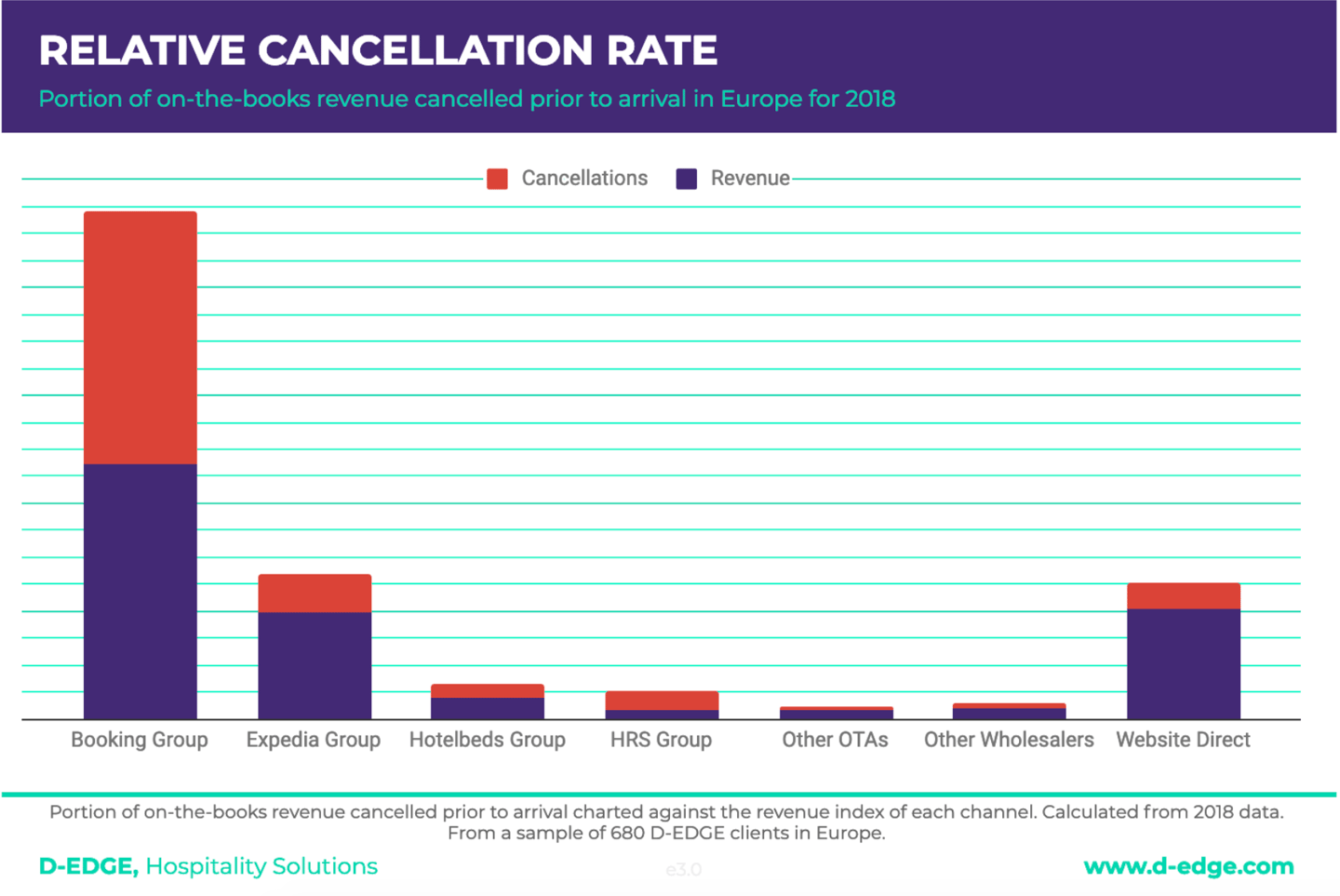

While it is true that Booking Holdings’ distribution channels have one of the highest cancellation rates, it is also true that it continues to out-perform all other channels. Further analyzing the data, D-Edge discovered that the average length of stay of canceled reservations is higher by a striking 65%, with a lead time of 60 days.

D-Edge data shows that larger reservations with longer lead times have a higher likelihood of getting canceled, and this additional information could help revenue managers predict what kind of reservations (and when) are more likely to be canceled.

D-Edge's research also produced data surrounding the following key facts:

1. Online Distribution has grown by 46.7% between 2014 and 2018

2. 71% of online distribution for independent hotels is generated by online travel agencies in 2018

3. Booking Holdings holds 68% of the OTA market share in 2018

4. Wholesalers and bed banks have grown by over 100% in 5 years

5. Website Direct remains the second most important sales channel, with 20.9% of market share

6. While still the second best channel, Website Direct has lost 6.3% share in 5 years, which has been taken over by OTAs

7. Almost 40% of on-the-books revenue is canceled before arrival in 2018

8. Average Length-of-Stay has diminished by 12%

9. After 4 years of negative trend, in 2018 the industry experienced an improvement in both length-of-stay and reservation value

10. Reservations with lead times longer than 60 days are 65% more likely to be canceled

To read the study in full, visit: https://www.d-edge.com/how-online-hotel-distribution-is-changing-in-europe/