News Briefs

- 5/21/2024

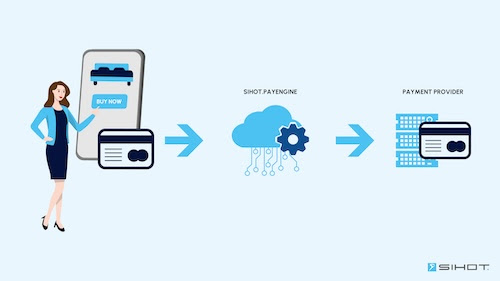

SIHOT Launches Payment Aggregator

SIHOT, a hotel management system, has launched SIHOT.PAYENGINE, a payment aggregator, to simplify payment processing for hotels and hospitality companies.

SIHOT.PAYENGINE can manage multiple Payment Services Providers (PSPs) offering accommodation providers choice rather than being restricted to a single provider. By offering hoteliers a centrally managed payment system seamlessly connected to all SIHOT products and Services through which all data runs, businesses can achieve greater operational efficiencies, cost savings and improved security for finance and account departments.

With SIHOT.PAYENGINE, hotels can facilitate the omnichannel payment experience to their customers across physical terminals or through ecommerce and payment apps, with the option to choose from a wide range of PSPs that match their preferences and cater to guests needs.

Said Carsten Wernet, Chief Executive, SIHOT: “We created SIHOT.PAYENGINE to enable hoteliers to choose which PSPs they want to work with for their business model. We are one of few PMS on the market to be agnostic to payment providers. By providing this level of connectivity, now PSPs are reaching out to integrate with our payment engine to provide our mutual customers with an elevated level of service and experience that improves business operations. There is an increasing need for hotels to work with a wide range of PSPs today, taking into account a multitude of digital payment channels and regional payment platforms. With our Cloud Native API, PSPs can quickly connect to our payment aggregator to integrate into our complete product suite.”

For hotels, the integration of PSPs in the PMS in this way means they can facilitate quicker checkout and billing processes using digital invoices and receipts, and ensure that customer payment data remains secure. SIHOT.PAYENGINE uses tokenistation to disguise credit card details on file while enabling repeat payments or a wider range of payment methods. Hotels can also ensure payments are pre-authorized, and that customer data in the loyalty program is fully PCI-compliant and GDPR protected.

“We know people spend more if payments are easy. Our payment aggregator means hotels can plug in a wide range of payment options that offer guests choice and a consistent hospitality experience,” added Wernet.

- 4/16/2024

Steak n Shake Deploys Biometric Check In

PopID and Steak n Shake announced today that all Steak n Shake locations in the United States now accept PopID Check In (to review favorite orders and loyalty points) and PopPay for checkout. With more than 300 locations, Steak n Shake is the first national restaurant brand in the United States to adopt biometric check-in and checkout nationwide. PopID’s biometric check-in feature makes kiosk ordering faster, easier, and more personalized.

The implementation of PopID in every Steak n Shake location was accomplished rapidly and at low cost through a partnership between PopID and ACRELEC, a leading supplier of kiosk-ordering hardware and drive-through products. Cameras were shipped to every restaurant for attachment to the existing ACRELEC kiosks. “As explained in our recent publication, ACRELEC believes that our integrated biometric solution provides various benefits to restaurant operators related to throughput, ticket size, and loyalty engagement,” says Bruno Lo-Re, President of ACRELEC America.

“We are thrilled about our partnership with PopID and to be on the edge of biometric technology for the benefit of our customers. Our guests now have the option to use biometrics for a faster and more seamless experience,” says Sardar Biglari, Chairman of Biglari Holdings, the parent company of Steak n Shake.

Now that biometrics are enabled for all ordering and payment inside Steak n Shake restaurants, PopID and Steak n Shake will begin implementing biometric check-in and checkout at the restaurant’s drive-through units. “Similar to the kiosks, biometric check in can increase loyalty participation and revenue at the drive thru while also reducing payment processing costs,” says John Miller, CEO of PopID and Chairman of Cali Group. “Additionally, biometric payment at the order confirmation screen enables staff members to work on tasks other than taking payments by card and phone at the order pick-up window.”

- 5/21/2024

Square Launches Tap to Pay on iPhone in Canada

Square launched Tap to Pay on iPhone in Canada. Available within the Square Point of Sale, Square for Retail, and Square Appointments iOS apps, Tap to Pay on iPhone lets sellers accept contactless payments directly from their iPhone with no additional hardware or payment terminal required and at no additional cost, making it a powerful free to enable option for entrepreneurs.

Through Tap to Pay on iPhone, Square is making it easier for both new sellers and established businesses to conduct in-person commerce. Any Square merchant with a compatible iPhone can accept contactless payments by simply opening the Square POS, Square for Retail, or Square Appointments app, adding the transaction, and presenting their iPhone to the buyer. The buyer completes the payment by holding a contactless payment method such as a contactless credit or debit card, Apple Pay, or other digital wallet, near the seller’s iPhone.

Apple’s Tap to Pay on iPhone technology uses the built-in features of iPhone to keep businesses’ and customers’ data private and secure. When a payment is processed, Apple doesn’t store card numbers on the device or on Apple servers.

Powered by Square’s elegant, intuitive software, Tap to Pay on iPhone gives sellers a flexible, mobile solution that can adapt to any environment while meeting evolving consumer preferences for contactless payments. Together with Apple’s contactless payment technology, Square’s software creates a smooth, straightforward checkout experience that provides shoppers with all the information needed to help them complete their purchase with confidence.

Tap to Pay on iPhone is already proving to be a valuable part of Square’s ecosystem after becoming available to millions of sellers in the US in late 2022 and most recently in Australia and the United Kingdom. Since launching, sellers of all types and sizes have found new value in the ability to seamlessly and securely conduct business with no additional hardware:

- Mobile professionals like tradespeople and caterers gained the ability to securely accept contactless payments onsite at their project location;

- Retailers found new efficiency through line busting and the convenience of helping shoppers complete their purchase wherever they are in store;

- Hairstylists and beauty professionals benefited from the speed and ease of enabling customers to pay for their services right from their chair.

“With Tap to Pay on iPhone, we are further levelling the playing field for businesses of all sizes to be able to start, run and grow,” said Saumil Mehta, Head of Product at Square. “The Canadian business landscape is competitive and tech savvy, always on the lookout for solutions that can make operating their business more efficient. Tap To Pay on iPhone helps reduce some of the barriers to entry for new businesses, and enables existing sellers to create new ways to sell with nothing more than their iPhone and Square’s software. They can get set up in minutes and begin making sales in seconds.”

Square sellers and new merchants can begin using Tap to Pay on iPhone today on an iPhone XS or later running the latest version of iOS, by downloading the Square POS, Square for Retail, or Square Appointments app from the Apple App Store. For more information, please visit squareup.com/ca/en/payments/tap-to-pay.

- 5/21/2024

Knowland Announces Sub-market Data Enhancement to Market Snapshot Report

Knowland, a provider of data-as-a-service insights on meetings and events for hospitality, announced an advanced data enhancement, Sub-Market Filter, to its popular Market Snapshot Report. The new filter was added to Knowland search and dashboard functions, including Market Snapshot and New-to-Market capabilities, enabling filtering down to the sub-market level within larger markets, saving time and effort by pinpointing localized opportunities.

As markets normalize and accounts continue to evolve in the meeting and events space, hotel sales teams need detailed data analytics to help them more easily source new business. This enhancement provides critical metrics on top geographical neighborhoods in a simple, easily accessible way, delivering essential insights sales teams need for an account-based approach to selling.

- Market Snapshot Updates—Knowland’s popular Market Snapshot feature can now be customized to help sales teams discover trends in meeting and event performance within a specific sub-market. It showcases sub-market level trends and analytics including key metrics, market segments, top industries, and average meeting size, providing valuable insights for informed decision-making. Click here for a quick preview.

- New-to-Market Capabilities—The sub-market enhancement to Knowland’s New-to-Market feature provides insights on accounts meeting in specific sub-markets for the first time, identifying new opportunities down to the local level. Sales leaders can choose to receive weekly, monthly, or quarterly updates via email, keeping them in the loop and providing insight to conduct account-based selling before competitors do. Click here for a quick preview.

Jeff Bzdawka, CEO, Knowland, said: “To stay agile in this competitive industry, hotel sellers must be savvy about community activity. With this localized market view, they see opportunities in their immediate area rather than sifting through broad datasets. We continue to innovate our platform with new features and functionalities to help sales teams excel in account-based selling and automate the sales process for better outcomes.”

- 5/20/2024

Costa Coffee Partners with Delaware North to Offer Autonomous Coffee Experience in Austin

Costa Coffee, in partnership with Delaware North, will launch its autonomous coffee technology, Costa Coffee Creations, at the Austin-Bergstrom International Airport in August.

Located at Gates 11 and 16, Costa Coffee Creations is a fully robotic system that delivers barista-quality espresso drinks without the need for any human assistance for up to seven days. The equipment, capable of serving both hot and cold beverages, utilizes 100% freshly ground whole beans, milk and alternative milk options.

Delaware North, an early adopter of Costa Coffee Creations, recognizes the transformative potential of autonomous coffee solutions. Costa's current coffee robot in the Austin Airport and a precursor to Costa Coffee Creations, has demonstrated remarkable success, achieving double the revenue per square foot compared to other offerings in the airport, which saw 22 million passengers fly in and out in 2023 alone.

Coffee Drinks 24/7

With a compact footprint of 24 square feet and round-the-clock availability, Costa Coffee Creations offers unparalleled convenience for travelers seeking coffee during non-traditional hours. Now, travelers will be able to get fresh, expertly crafted coffee drinks during those midnight hours or any other time they desire premium espresso beverages.

“Amid persistent labor shortages and growing consumer demand for convenience and personalization, Costa Coffee Creations emerges as the perfect solution,” said Nick Rex, Senior Director at Costa Coffee. “With the ability to concoct an infinite array of coffee options in minutes and facilitating seamless mobile ordering, all without the need for human intervention, the machine embodies a win-win scenario for operators and guests alike.”

"The tech-forward city of Austin is the perfect first location for Costa Coffee Creations,” said Terry Mahlum, a director of operations for Delaware North’s travel division. "Our partnership with Costa emphasizes our commitment to continuous innovation and delivering superior guest experiences."

By partnering with Delaware North at the Austin airport, Costa Coffee Creations continues to lead the coffee market evolution through innovation, disrupting traditional coffee retail experiences and setting new standards for excellence in the industry.

- 5/21/2024

BeCause and d2o Team Up to Create CSRD Solution for Travel and Hospitality

BeCause, a Danish start-up transforming how the global hospitality, travel, and tourism industries manage their sustainability data, has partnered with d2o, a forecasting and resourcement management technology provider for the hospitality industry, to create a comprehensive Corporate Social Responsibility Directive (CSRD) solution for hotels. The collaboration unites the BeCause Sustainability Hub with d2o's PMI GoGreen suite of prediction, targeting, tracking, and allocation tools to create an auditable CSRD reporting solution that goes beyond compliance to boost efficiency and profits. The partnership was announced yesterday at the World Sustainable Hospitality Alliance Spring Summit in Nice, France.

By joining forces, BeCause and d2o have taken a giant leap toward building a viable, valuable ecosystem between the hotel industry and technology providers that leverages the power and potential of daily sustainability data management. CSRD compliance is just the starting point; BeCause and d2o are demonstrating that with the right technology, sustainability initiatives can drive operational efficiency and profitability for hotels around the world.

"As an inventor and entrepreneur, it is a dream come true to have a product that fully meets the needs of our customers' stakeholders, including owners, guests, staff, authorities, and local communities," says d2o CEO Young Nguyen. "The partnership between d2o and BeCause will enhance the hotel industry's ability to transform a costly compliance challenge into a business opportunity. We call this partnership PMI GoGreen BeCause… because the hotel industry and the planet require a comprehensive solution to address a complex issue."

Going Beyond CSRD Reporting and Compliance

As a result of this partnership, the PMI GoGreen tools will be seamlessly integrated into the BeCause platform. This integration, facilitated by an API, allows for the sharing and mapping of data, making it reusable for CSRD reporting. This not only simplifies the compliance process for hotels but also ensures accuracy and auditability at the activity level, meeting financial-grade CSRD reporting standards.

However, the joint solution goes beyond compliance and reporting. By centralizing data within the BeCause platform and applying the integrated PMI GoGreen tools, hotel chains gain visibility into which individual properties are meeting their targets for reducing CO2 emissions, energy consumption, water usage chemicals, waste, towels & linens, and food waste. The combined solution also utilizes machine learning algorithms and predictive analytics to identify those targets and help properties optimize resource usage to meet them amidst daily fluctuating demand. System integration service ensures seamless interoperability between the BeCause Sustainability Hub, PMI GoGreen tools, and various internal hotel systems, including property management, point-of-sale, table reservations, sales and catering, timekeeping, and more.

These combined capabilities allow hotels to increase efficiency—hotels are projected to reap 12-15% in resource savings—cultivate ownership among frontline managers, showcase their sustainability efforts to travelers, and, of course, meet their CSRD compliance obligations.

"We believe in the power of ecosystems, and by partnering with d2o, we've built a particularly effective one," says BeCause CEO and Co-founder Frederik Steensgaard. "Not just in terms of helping hotels reach CSRD compliance, but by using the combined capabilities of our solutions to address everyday issues that impact their margins and organizational effectiveness. Why should compliance and reporting be a cost-heavy headache for hotels when it could be driving profitability and operational efficiency?"

An Efficient Solution Specifically Designed for Hospitality

BeCause is a purpose-built, AI-powered hub that centralizes a hotel's sustainability data and automates the transmission of that data amongst different stakeholders, such as travel and accommodation booking marketplaces and industry certifications. Additionally, once a hotel enters its data into the BeCause platform, it can be upcycled and automatically mapped to multiple frameworks, making qualifying for voluntary green certifications faster and more efficient while ensuring regulatory compliance.

The PMI GoGreen suite of tools developed by d2o enables hospitality groups to achieve their long-term environmental goals by breaking them down into monthly targets tailored to each property's attributes and seasonal variations. Each hotel's future targets are dynamically adjusted based on progress, ensuring the consistency of the group's end goal. Individual hotels and hotel chains can track their progress with forward looking data-based indicators and utilize predictive analytics to optimize resource allocation, minimize waste, and cut operating costs.

The combined PMI GoGreen BeCause solution leverages these capabilities to deliver at least 100% ROI for hotels that implement it. The solution will undergo a phased roll-out through the summer of 2024 before formally launching in September.