News Briefs

- 9/13/2023

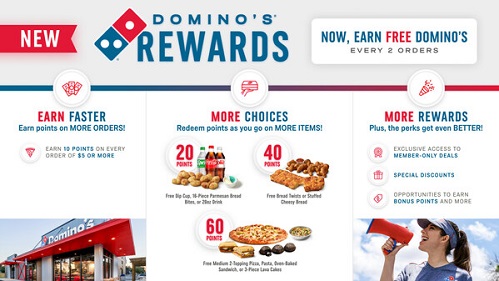

Domino's Updates Rewards Program

Domino's Pizza Inc. introduces its new and improved loyalty program.

Domino's Rewards offers loyalty members even more opportunities to earn and redeem points across its corporate and franchise store locations. Domino's enhanced rewards program allows customers to:

- Earn points for less

- Loyalty members will now earn 10 points on every order of $5 or more

- Redeem points for even more menu items – and earn free Domino's after just two orders

- Members can redeem a variety of points for more menu items:

- 20 points: A free dipping cup, a 16-piece order of Parmesan Bread Bites or a 20 oz. drink

- 40 points: An order of Bread Twists or Stuffed Cheesy Bread

- 60 points: A medium, two-topping pizza; pasta; Oven-Baked Sandwich; or a 3-piece order of Chocolate Lava Crunch Cakes

- Members can redeem a variety of points for more menu items:

- Earn more rewards

- Loyalty perks are now even better, as members will have exclusive access to member-only deals, special discounts and opportunities to earn bonus points!

"We are thrilled to give the brand's loyal customers additional ways to earn free Domino's items more often," said Mark Messing, Domino's vice president of digital experience and loyalty. "At a time when most brands are scaling back their loyalty programs and making it more difficult to earn and redeem points, Domino's is doing the opposite. We want to make it easier to reward our customers and give them more options so they can get rewarded faster."

Marketing a LTO

From now until Oct. 22, 2023, rewards members can take advantage of a limited time offer to redeem 20 points for a free order of Domino's new Pepperoni Stuffed Cheesy Bread, which is normally a 40-point redemption, in celebration of the product's recent launch.

- Earn points for less

- 2/11/2024

Nékter Juice Bar Partners with Qu to Unify Ordering Channels

Nékter Juice Bar has selected Qu as its preferred POS partner for all the company’s locations, including more than 300 open or in development.Nékter will standardize on Qu’s platform to holistically manage all order channels and unify guest, order and menu data. In addition, Nékter will leverage Qu Flex kiosks to improve guest service and labor efficiencies. Qu Flex serves as both a guest-facing kiosk and a traditional POS, allowing team members to quickly pivot between roles based on demand and labor availability.“Growth is a huge step for any restaurant brand and it’s critical to manage it responsibly for long-term success,” said Steve Schulze, co-founder and CEO of Nékter Juice Bar. “As we take our brand into the future, Qu’s omnichannel approach to simplifying the technology ecosystem is in perfect alignment with our goals.”Qu’s underlying cloud-native software platform provides a solution that allows Nékter franchisees to work more flexibly and generate additional sales opportunities while maintaining the brand standards that Nékter guests expect. Instead of a fragmented technology stack, Qu offers a unified omnichannel ordering universe for operators and guests. By seamlessly connecting the ordering, operations and brand functions, Qu delivers the real-time data needed to drive loyal, repeat customers and healthy revenues.Qu’s versatile Flex kiosk offers POS capabilities with the same order and payment flow but adds the functionality of a kiosk without additional hardware and space costs. With smaller footprint stores that use staff for both cashiers and food prep, this solution is perfect for Nékter. Thanks to the Qu kiosk, franchisees will be able to shift their POS to a self-service order taker when staffing is tight or otherwise engaged. In addition, Nékter guests are empowered with the type of menu choices and customization that increases per ticket averages, increasing overall sales.

Nékter Juice Bar has selected Qu as its preferred POS partner for all the company’s locations, including more than 300 open or in development.Nékter will standardize on Qu’s platform to holistically manage all order channels and unify guest, order and menu data. In addition, Nékter will leverage Qu Flex kiosks to improve guest service and labor efficiencies. Qu Flex serves as both a guest-facing kiosk and a traditional POS, allowing team members to quickly pivot between roles based on demand and labor availability.“Growth is a huge step for any restaurant brand and it’s critical to manage it responsibly for long-term success,” said Steve Schulze, co-founder and CEO of Nékter Juice Bar. “As we take our brand into the future, Qu’s omnichannel approach to simplifying the technology ecosystem is in perfect alignment with our goals.”Qu’s underlying cloud-native software platform provides a solution that allows Nékter franchisees to work more flexibly and generate additional sales opportunities while maintaining the brand standards that Nékter guests expect. Instead of a fragmented technology stack, Qu offers a unified omnichannel ordering universe for operators and guests. By seamlessly connecting the ordering, operations and brand functions, Qu delivers the real-time data needed to drive loyal, repeat customers and healthy revenues.Qu’s versatile Flex kiosk offers POS capabilities with the same order and payment flow but adds the functionality of a kiosk without additional hardware and space costs. With smaller footprint stores that use staff for both cashiers and food prep, this solution is perfect for Nékter. Thanks to the Qu kiosk, franchisees will be able to shift their POS to a self-service order taker when staffing is tight or otherwise engaged. In addition, Nékter guests are empowered with the type of menu choices and customization that increases per ticket averages, increasing overall sales. - 2/11/2024

Wyndham Simplifies Group Travel, Brings Instant Booking to 5,600+ U.S. Hotels

Group bookings across the industry's largest portfolio of economy and midscale hotels will soon take minutes—not days—thanks to Groups360 and the rapid rollout of over 5,600 Wyndham hotels to the GroupSync™ Marketplace.

The shift is a welcome change not just for traditional travel planners (think meetings, weddings and events) but also travel managers, particularly those in infrastructure-centric fields like construction and logistics, whose crews need to spend weeks if not months on the job, often with as little as 24-hour's notice.

Through GroupSync, travel planners and managers can browse real-time rates and availability at participating hotels and directly book 10 to 50 rooms without needing to contact the hotel or engage in a traditional RFP—saving valuable time. Meeting space for events can also be booked at hotels when needed and where available.

"We're always looking for new ways to make it simpler and easier for clients to do business with Wyndham. Whether it's a family reunion, a youth sports tournament or a three-month-long bridge repair project—GroupSync makes it simple for groups to find the right hotel at the right price and book on the spot," says Angie Gadwood, SVP Global Sales, Wyndham Hotels & Resorts.

"Wyndham is one of the world's leading hospitality companies and their portfolio is unique in that it represents key property categories that expand GroupSync's Instant Booking inventory. In bringing their U.S. portfolio on board, we're able to deliver a broader, more robust, more inclusive offering—one that's better equipped to meet the needs of all travel planners and managers," says Kemp Gallineau, CEO, Groups360.

Wyndham's collaboration with Groups360 is the latest in a list of efforts to help its hotels tap into a multi-year, infrastructure-related travel boom and what it believes is a ~$3.3 billion revenue opportunity for franchisees. Last year, the Company expanded its Global Sales force by 25% and more recently, deployed new tools to help sellers better identify and capture infrastructure-related opportunities for franchisees.

Groups360 and GroupSync are also a part of Wyndham's innovative Wyndham Business program which, through a suite of tools and resources, aims to help make business travel easier for all. The program caters to small and mid-size business owners, travel advisors, travel buyers, meeting planners and more—all while offering discounted rates and exclusive perks.

The majority of Wyndham hotels in the U.S. are anticipated to be available for instant booking on GroupSync this week with the last remaining hotels expected to go live before end of month. To browse hotels, check-rates and availability, or complete a booking, visit groupsync.com.

- 2/11/2024

Presto Raises $6M, Wins Appeal Against XAC

Presto Automation Inc., an AI and automation technology provider to the restaurant industry, has closed a financing led by its existing investors, including Remus Capital, a fund controlled by the Company’s Chairman, Krishna K. Gupta, and other investors, involving the sale of $6.0 million of convertible subordinated notes. One of the existing investors is also exchanging 3.0 million shares of the Company’s common stock which was purchased on November 21, 2023 for $3.0 million of Notes.

“This capital injection is a strong signal of my commitment to Presto and its shareholders - we have tremendous belief in the Company’s prospects in its rapidly-growing market and our continuing efforts to enhance shareholder value,” said Gupta.

“On the commercial side, our Presto AI Voice product serving the drive-thru restaurant market is enjoying significant momentum. Over a period of 2 months, we have more than doubled our total number of live stores on the Presto Voice technology to 145 as of February 1, 2024, including 54 locations that use the most advanced version of our AI technology. Restaurant operators are embracing our solution in part due to the California $20/hour minimum wage mandate which is taking effect on April 1."

In addition, Presto recently entered into an amendment to its Cooperation Agreement with Hi Auto Ltd., which supplies the AI technology used at 347 Checkers corporate and franchised locations. Commencing on May 1, 2024, the Company and Hi Auto will each be permitted to compete for the Checkers relationship, including franchised locations.

Presto also announced that its Chief Executive Officer, Xavier Casanova, has resigned effective immediately.

In other news, on February 8, Presto received a court order representing the favorable verdict received from the Singapore Court of Appeal in the final hearing of its case against XAC Automation Corp (5490.TWO) on January 16. The favorable verdict dismissed XAC’s appeal and upheld the award of $11.1 million previously made to the company adding an additional $32,000 award for costs associated with the appeal. XAC has no further recourse to set aside the award. Domesticating the award in Taiwan may take between several months to more than a year.

The Notes are convertible into 36 million shares of common stock at an initial conversion price of $0.25 per share and carry an interest rate of 7.5% per annum on a pay-in-kind basis. The issuance of the Notes triggered antidilution adjustments associated with the Company’s previous financing rounds.

The Company projects that the net proceeds from the offering, together with its other cash resources and projected revenue, are sufficient to sustain operations through the end of February 2024. The Company is required to raise at least an additional $6.0 million in gross proceeds on or before March 8, 2024 pursuant to the terms of the Forbearance Agreement it entered into with its lenders in order to receive additional forbearance.

- 2/10/2024

Givex's Role in KFC Canada's National Kitchen Tech Upgrade

Givex Corp.'s longtime client KFC Canada has completed a national kitchen technology upgrade across 402 stores implemented to improve the guest experience across all digital platforms. This upgrade is part of KFC Canada's long-term strategic initiative to leverage technology to meet evolving customer expectations in the ultra-competitive QSR space.

To support this upgrade, Givex partnered with Lenovo Canada and KFC Canada's internal application team to integrate the solution into the stores' existing IT infrastructure. Going forward Givex will support the hardware platform as part of its ongoing service agreements with the KFC Franchisee group.

"This announcement showcases Givex's evolution as a national enterprise level service provider," said John Beaton, President of Kalex Equipment Services, which was acquired by Givex in 2022. "Givex's acquisition strategy is now delivering the synergies which will not only expand the services we provide to our existing clients but also provide the platform to deliver Givex services and products to an exponentially broader client base."

With 12 global offices and a footprint of more than 128,000 active merchant locations, Givex offers gift cards, point-of-sale system GivexPOS, loyalty programs, Enterprise Services, GivexPay and more.

- 2/11/2024

Davidson Hospitality Group Adds Digital Tipping

Davidson Hospitality Group, an award-winning, full-service hospitality management company, has added eTip as its digital tipping partner.

“At Davidson, one of our core values is to create value in all that we do and adopting eTip’s solution does exactly that,” says Thom Geshay, Chief Executive Officer & President, Davidson Hospitality Group. “We are excited to leverage innovative technology that adapts seamlessly to the evolving needs of our guests, team members and ownership partners.”

The news comes on the heels of eTip’s recognition as the preferred tipping partner for some major global hotel brands, and its designation as a digital tipping solution partner for both Visa & American Express. As the demand for cashless tipping rises among hotel guests, forward-thinking hoteliers are turning to eTip's user-friendly platform to improve guest satisfaction, streamline tip management, and boost staff retention.

eTip requires no mobile app download or login credentials. Guests simply scan a QR code using the camera on their mobile phone, tap the banner on their screen, and then tip using their preferred payment method. eTip also offers “tap to tip,” allowing guests to pay through an NFC-enabled QR code. eTip makes digital tipping easier and faster for guests.

Thanks to eTip’s platform, properties managed by Davidson Hospitality Group utilizing the eTip program can now enjoy:

- Gratitude in a Few Clicks: Guests can express their appreciation for exceptional service with just a few taps on their smartphone, using the intuitive interface.

- Insightful Reporting: eTip provides access to comprehensive reporting features, enabling analysis of tipping trends, evaluation of staff performance, and guest satisfaction insights.